Where to invest pension savings rating. Everything about funded pension. What should you do

Transferring the funded part of the pension so that it does not go to the insurance, but serves as a source of small income, is the responsibility of every citizen insured by the Pension Fund of the Russian Federation.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FOR FREE!

Therefore, you should thoroughly study the generally simple process of processing a transfer, do not miss the transfer deadlines, and also take care to choose the most reliable insurer - NPF (non-state pension fund), which will offer optimal insurance conditions.

Deadlines

Any worker in Russian Federation, officially registered under labor legislation, receives its income with contributions to compulsory insurance already deducted. The same applies to a state pension fund.

The employer transfers only 22% of contributions from the employee’s earnings to the Pension Fund, 6% of which is the funded part.

Innovations introduced in pension legislation, now they oblige policyholders to choose either this 6% will go into the insurance part of the pension (in fact, the entire pension then becomes insurance), or transfer this interest to a non-state pension fund, as a contribution, investment.

And for this purpose, legal norms provide their own regulations for the transfer deadlines, during which it is necessary to have time to re-register the funded part of the pension in a non-state institution.

Recent changes in insurance legislation regarding pension provision Citizens who have reached a certain age are literally rushing citizens to determine the funded part of their pension to a non-state fund or to abandon it altogether.

Urgency was dictated latest law in this matter dated 12/04/13, with innovations introduced into it dated 12/14/15.

If a current or future pensioner does not choose before the deadline where exactly he would like to allocate the funded part of the pension, then he automatically goes into the status of “silent”.

For these people, 6% of the contributions made by the employer will be transferred to the insurance part of the pension.

The deadline was officially set until 01/01/16, however, until 04/01/16, the accumulative part of the pension benefit of the “silent people” (not transferred to the NPF) will remain untouched by indexation (transfer to the insurance part).

But after April 1, 2020, they will begin to index the funded pension into the insurance one. It is also worth noting that from January 1, 2020, all employers will make contributions to the Pension Fund of the Russian Federation without any splitting into savings and insurance parts.

Now they just transfer the contributions which all go to insurance pension. The state Pension Fund is directly responsible for accounting, distribution and settlement of contributions received from employers.

Where is the best place to translate?

For working insured persons who have taken care of transferring their savings portion to a non-state pension fund, there will be a slightly different procedure.

If a citizen wants to retain the right to use the savings part, and at the same time earn a little money, then he simply transfers the accumulated funds to a non-state pension fund.

At the same time, the employer will continue to pay required contributions to the state fund, and directly the Pension Fund of these contributions (22%) will regularly transfer 6% to the NPF, which you indicate in the application.

After all, when making a transfer, two main applications are submitted - directly to the NPF to conclude a compulsory pension insurance agreement, and to the Pension Fund of the Russian Federation to notify where exactly 6% should be transferred (the details of the policyholder’s personal account and the data of the NPF in which the savings are stored are indicated).

The choice of where to transfer your accumulated pension is quite large. But from all the diversity, two main directions can be identified where citizens transfer such parts of social security.

Two options for choosing places to save and increase pension savings are as follows:

The difference between registering accumulative pension savings in a management company or a non-state pension fund is only in concluding an agreement on compulsory pension insurance of citizens.

An agreement is concluded in a non-state pension fund, but not in a management company. The management company only needs to submit your application to the Pension Fund with a request to transfer the funded part of the pension to its financial platform (client’s personal account registered with the Criminal Code).

Among the management companies there are the most reliable ones, such as GUK - a state management company such as Vnesheconombank.

Both NPFs and management companies operate a mechanism for providing interest rates to the deposits of clients’ portfolios - their deposits, in this case in the form of a transfer of the funded part of the pension.

Pension Fund Rating

In total, there are about 125 non-state funds in the Russian Federation, to which policyholders of compulsory pension insurance can easily apply for services for re-registration of funded pensions.

But you should not trust all the funds, because among the general mass there are those that provide services intermittently, with unfavorable conditions, with late payments and other inconveniences.

It is these inconveniences that can create additional risks for policyholders who turn to non-state insurers, seemingly for insurance against all possible risks.

Therefore, before making the final choice of an insurer, you should study the ratings, degrees of reliability and public reviews of the companies.

The ten richest insurers that guarantee timely payments to clients:

In addition to the income part, attention is also paid to the rating of a particular NPF. In total, expert rating opinions are divided into three levels:

How to find out where the funded part of the pension has been transferred

Situations when everyone wants to know about the status of their personal account with funded pensions require, first of all, confident knowledge of the place where exactly such an account is located.

At some enterprises, employers who receive agency fees from one or another insurer (sometimes from several insurance companies, if the enterprise is large), employees may be offered several options for insurers.

In this case, transfers of the funded part of the pension to the NPF are carried out centrally. Employees write their applications to one or another NPF and a power of attorney to the authorized person involved in the transfer of employee pension savings.

The employer himself takes care of proper registration with a full completed cycle of all translations. At the same time, he receives an additional benefit, a percentage from the insurer for attracted clients.

Clients themselves sometimes get confused and do not always remember which non-state pension fund they wrote an application to. Or they remember, but just want to make sure that it was to this NPF that his funded pension was delivered on time, and that his personal account was created, as well as access to his personal account.

In addition to this situation, others may arise when a person does not know his non-state pension fund where he is insured. For example, if a notification from the fund with which you entered into a compulsory insurance agreement does not arrive for a long time.

And such a notification must come by mail. But if you changed your place of residence, permanent registration, and did not notify the pension fund, then you may not receive a notification.

To verify all this in these cases, you just need to follow a few steps or several options for obtaining the necessary information:

- Contact any territorial branch of the state Pension Fund. The standard application process also involves submitting an application to the state pension fund, so all information on the transfer of accumulated pension benefits is stored there.

- If there is no way to contact the territorial Pension Fund, then try to act through your employer’s accounting department. Since accountants make transfers for compulsory pension insurance, they regularly contact the Pension Fund.

- On the government service website or on the website of the State Pension Fund itself, people learn about their NPF through the entered SNILS data - a certificate of registration as an insured in compulsory pension insurance. The algorithm of actions in this case should be as follows:

- registration on the Unified Government Services Portal;

- upon registration, the site visitor receives an activation code by regular mail to the address you specified, at any Rostelecom post office or to his or her electronic mail;

- also, upon registration, confirmation of your electronic signature will be required;

- or the identity is confirmed using the UEC (universal electronic card), if the citizen has one;

- Upon completion of registration, you will have access to your personal account, where following the instructions you can easily obtain the necessary information.

- Contact any banking organization with which the state pension fund has a cooperation agreement. You can choose any branch from the following list of banks cooperating with the pension fund:

- Sberbank;

- UralSib;

- Bank of Moscow;

- VTB 24;

- GazPromBank.

Every officially employed person dreams of a comfortable old age, for whom the employer contributes monthly insurance amounts to the Pension Fund. Overall size Such contributions amount to 22%, and six of them, until recently, accumulated in the citizen’s personal account.

You can manage these funds yourself (for example, make a payment or transfer them to heirs). Whereas the bulk of insurance premiums are under state control– current pensions are paid from this general fund.

Since 2014, the funded or personal part of pension funds has been reduced, according to a government decision, to zero percent.

That is, employers will no longer make contributions taking into account the amounts intended for the personal accounts of the company’s employees. You will only be able to retain the usual 6% if you transfer these funds. If you do not complete the transfer, the savings part will be abandoned by default (as initially decided by state authorities) - all the money will be in the insurance part, uncontrolled.

The funded parts of pension funds are frozen by the state for 2016 as well.

Citizens still have time to accept correct solution– choose where exactly to invest your money.

After the funds are transferred, they will become a real deposit, generating profit in the form of interest. The higher the income of the financial organization in which the investments were made, the faster the size of the former funded part will increase.

We remind you that the reform will only affect people born in 1967.

Where is the best place to transfer?

Leave it in the state pension fund

If the money remains in the state pension fund, from the end of 2016 it will be automatically credited to the general insurance part. This is the so-called default enrollment.

Advantages - no need to translate.

Flaws:

- the funds will not work - no interest rates are provided for them;

- Only those conducted annually in accordance with the coefficient established by the government will be taken into account;

- there are no guarantees of receiving your funds by the time of retirement;

These savings cannot be inherited.

Transfer to a non-state PF

If the money is transferred by the recipient (future pensioner) to a non-state pension fund, it will turn into investments and begin to generate income.

Advantages:

- the increase reaches 8-14%, depending on the rating and profitability of the fund - the investor not only covers inflation, but also receives real profit;

- the funds can be registered as an inheritance without any problems.

Flaws:

- there is a possibility of dissolution of non-state PFs;

- the fund may be downgraded in the rating system, and, therefore, a decrease in income for its investors.

Refuse the savings part

If you completely refuse, the insurance part when applying for pensions will be calculated taking into account 22%, which will increase the number of points.

Advantages:

- payments will increase due to additional payments taken into account by PF employees when

- registration of a pension;

- funds will be indexed.

Flaws:

- there will be no additional annual profit, since the funds will not be considered an investment (interest on the fund’s income is not accrued);

- funds cannot be inherited.

Rating table for non-state pension funds

You can choose a non-state PF based on the entire list of such organizations compiled by the state PF and posted on its website. Funds that have been consistently in the top ten for a long time deserve special trust..

This position is eloquent evidence of stability and reliability.

Of course, no specialist can give a 100% guarantee in this case.

The difficult economic situation and constantly changing inflation indicators do not allow us to make a long-term forecast in this area.

- Profitability level. Indicators for the entire period of the fund’s activity are taken into account, and not just for the last year. If the rating does not contain information on this item, this means only one thing - the leaders of the organization are hiding the true state of affairs from the public. Such a “wake-up call” should alert a potential investor.

- Reliability is determined by more than twenty-five parameters. The analysis is carried out for each quarter separately and for the year as a whole. After which the experts assign a certain class to the fund (a total of five classes are taken into account in the rating table).

A high class is marked with the letter “A”, a very high class is marked with “A+”, and an exceptionally high class with “A++”.

In the table compiled by Expert RA, it looks like this (the information is current for the first quarter of 2016):

The most impressive results are from the leader of the rating – the European Pension Fund. The fund's accumulation in 2015 amounted to 57.7 billion rubles. From 2009 to 2014, all of his clients' investments doubled.

And “Surgutneftegaz” received a high rating of reliability thanks to an impressive reserve of 15,349,000 rubles. This is one of the richest funds in the country.

Specialists also considered MNPF Big to be reliable in all respects. The fund has been operating since 1995, and its client base numbers more than 500,000 people. The organization has always fulfilled its obligations to investors even in the event of an unfavorable economic situation.

The second list of the rating is distinguished by a rather conservative financial policy, which increases its reliability in the eyes of experts. Client funds are invested by the Defense Industrial Fund exclusively in securities, bonds and shares.

Another fund with stable indicators of reliability and profitability is in fourth place. This organization is involved in state program, which consists in co-financing pensions. Experts have classified the Education and Science Non-State Pension Fund as one of the most reliable non-state funds.

The dynamics of rating assignment can be found on the agency’s website (the table is constantly changing depending on the analysis performed).

Do you have doubts about where it is better to transfer the funded part of your pension? What rules have been approved and are in force in 2020?

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FOR FREE!

A modern person is constantly busy and cannot always find time to find out information about pension payments in the future.

So you can deprive yourself of the opportunity to choose the option that will ensure old age. It is important to understand what is the purpose of transferring funds from the funded part of the pension to the pension fund.

Basic moments

Let’s define what is meant by insurance and funded pensions and how and where they are transferred.

What it is

Pension contributions have an insurance and savings part. Insurance funds are transferred to the state pension fund of the Russian Federation and spent on payments to pensioners.

The part that remains is considered cumulative, and it is recorded in personal personal accounts in a fund that the citizen chooses himself.

The funded part is the second pension, and it can increase if the income of the management organization increases.

This part of the pension is formed from contributions paid by employers, as well as insurance transfers.

To receive such a pension, you should prepare an application and submit it to a representative of a state or commercial fund.

Pension contributions amount to 22% of earnings and are made by the management of the company in which the person works. 16% goes to the insurance pension, the rest represents the funded part.

The amount of the funded part of pension accruals is established taking into account the amount that is in the citizen’s account and the period during which payment is expected.

The savings portion is increased when a voluntary contribution is made.

If you replenish the account yourself, government agencies will transfer the same amount to the account, but within the limits of 12 thousand rubles per year. That is, we will talk about a co-financing program.

Payment of money from savings accounts is possible:

- if the account owner dies;

- if a person receives disabled status;

- if a family loses its breadwinner.

Urgent payments can be made if there are additional transfers. The savings system is available only to those citizens who were born no earlier than 1967.

If a person does not take care of transferring funds, they will automatically be transferred to the insurance part, as a result of which the amount will increase pension payments in future.

What are the types of funds?

There are such funds:

- state – budgetary, extra-budgetary;

- non-state.

Extra-budgetary funds:

- PF of Russia;

Legal regulation

Information on non-state pension funds is contained in Federal Law No. 75 dated May 7, 1998.

There are also a number regulatory documents that need to be considered:

Where can I transfer the funded part of my pension?

Anyone can entrust their savings to pension funds.

The procedure is as follows:

You can change the organization annually if you send a corresponding request to the Pension Fund branch.

List of available options

Way to invest the funded part of your pension:

| No action | The money will remain in the state fund, and Vneshconombank will manage it. Plus - the funds are guaranteed to be returned. But the state will not promise that old age will be secure |

| Transfer the savings portion to a private company | The funds will remain in government agencies, but management will be taken over by the organization that invests the pension. The amounts of money will be in securities, bonds, etc., as a result of which the account owner will receive a profit |

| Prefer one of the non-state pension funds | In this case, the funded part is sent to a non-state pension fund, which will accumulate financial assets |

Which fund you prefer is up to you. But it’s worth knowing that if you don’t contact the Pension Fund, you can’t count on the 6 percent amount of contributions to the funded part.

When choosing an organization, you should pay attention to its profitability and reliability.

Where is it more profitable to transfer funds?

Where should I transfer my funded portion of my pension? Leaving the funded part of your pension in the state pension fund is advisable if you have less than 10 years left until retirement.

In other cases, it is better to choose a non-state fund. Check these points:

- does the company have a license;

- review financial statements;

- what is the number of policyholders;

- investment result.

First, they study the history of the fund and ask what conditions are offered. No one, of course, can guarantee that the pension will be increased in the future, but the risks of losing savings cannot be allowed.

So, pay attention to the type of fund:

| Captive | Engaged in the promotion of corporate pension programs of companies. The pension reserve contains more savings. These are Welfare, Transneft, Neftegarant, etc. |

| Corporate | Engaged in servicing the founder's pension programs. The share of savings increases annually thanks to clients. This is, for example, Norilsk Nickel |

| Universal | Does not depend on the financial group. Both citizens and companies are served. More retirement savings. This is the European PF, Keith Finance |

| Territorial | Acts in one or more areas. Support is provided by local authorities. This is, for example, Khanty-Mansiysk Non-State Pension Fund |

The main indicators include assets, reserves, savings, the number of people who are insured, the pension reserve, the date when the fund was founded, etc.

Consider the following points when choosing:

But not all such organizations are worth trusting, because some offer unfavorable conditions, delay payments, etc.

A number of such inconveniences create a risk for the policyholder that they turn to a non-state company. Therefore, study the rating of each organization, the level of reliability, and people’s reviews.

The funded part of the pension can be returned to the state pension fund:

- if there is such a desire;

- in the event that an event occurs that makes it necessary to return the funds.

But it remains possible, if desired, to redirect funds again to one of the management companies or non-state pension funds. To transfer to the Pension Fund of the Russian Federation, you need to write an application. But this cannot be done more often than once a year.

You will need the following documents:

- identification;

- SNILS;

- other papers that were issued by the Pension Fund of the Russian Federation.

The transfer of the funded part of the pension from the NPF to the Pension Fund is mandatory in the following cases:

- NPF has been deprived of its license;

- the face is dead;

- the contract was terminated, which was concluded under compulsory insurance programs;

- The NPF is insolvent and bankruptcy proceedings have opened.

Which place is more reliable?

You can rely on the following table:

If a person does not make a choice in favor of any organization, 6% of the funded part remains in the pension fund of the Russian Federation. And such funds will be reset to zero from 2020, that is, transferred to the insurance part.

Video: where to transfer the funded part of your pension?

In this case, the person cannot receive any interest, since this money repays the debt of the Pension Fund of the Russian Federation. The big disadvantage of an insurance pension is that it cannot be inherited.

If you decide that you will transfer funds to a non-state pension fund:

How to find out where the amount was transferred

In some organizations, the employer that receives agency fees from insurers may offer employees more than one company option for insurance.

In these situations, the transfer of the funded part of the pension to a non-state fund is centralized.

The employee must write an application to a specific fund (for example, the Gazfond) and prepare a sample for authorized persons who will handle the transfer of funds.

Employers carry out the registration procedure themselves. In addition, they can receive interest from insurers for each attracted client.

The employees themselves do not always even remember which fund they applied to.

Or they simply want to make sure that the funded portion is received within the agreed time frame and personal accounts are created.

Another situation may arise when a person does not know his non-state pension fund, where the insurance was carried out. For example, a notification did not arrive from the organization with which the contract was concluded.

How to find out NPF:

| Contact the regional branch of the State Pension Fund of the Russian Federation | After all, when completing the application, the application was also submitted to this fund. This means that they can provide you with information about the transfer of the funded part of the pension. |

| If you cannot come to the branch of a government agency | Then proceed this way - contact the accountant of the company where you work. The accounting department makes transfers for compulsory insurance, which means they have a constant connection with the Pension Fund |

| Go to the State Services website and when you enter SNILS you can find out the information you are interested in | To do this, you need to register on the portal, confirm your electronic signature, UEC (if any). Then you can log into your personal account and use the services |

| Contact the bank with which the state pension fund entered into an agreement | This could be Sberbank, UralSib, GazPromBank, etc. |

Russians still have many options when choosing a non-state pension fund. But this must be done consciously and responsibly

Photo: Fotolia/Photobank

November and December are traditionally the busiest active months, when Russians rush to choose a pension fund to which they can entrust their savings. This year, about 4.7 million people have already applied for pension transfers. But how not to make a mistake when choosing a fund? What should you pay attention to?

The “silent people” are no longer silent

VEB’s assets currently contain about 1.8 trillion rubles in pension savings, versus 2.4 trillion rubles that have accumulated in the accounts of non-state pension funds. Judging by the speed with which citizens are fleeing the state, the pension piggy bank of the state management company will continue to “thinner.” This year, more than 2.6 million “silent people” have already decided to withdraw their money from VEB.

Future pensioners are not stopped either by the risks of changing the state management company to private funds, or by the loss of profitability. 99% of transfers from VEB to NPFs were ahead of schedule. Last year, due to early transfers, they lost about 27 billion rubles, Nikolai Tsekhomsky, First Deputy Chairman of Vnesheconombank, said in August. In total, citizens took over 240 billion rubles of pension savings from VEB.

But are Russians so wrong when they decide to change the manager of their pension, despite the risks of losing earned income? Market participants attribute the increase in transfers to private non-state pension funds to the activity of intermediary agents, but there are other reasons. In particular, any person who is even more or less knowledgeable about the pension system knows that, unlike PFR pensions, savings in NPFs can be inherited. It is clear that many people prefer, if something happens, to transfer money to relatives rather than donate it to the state.

Another reason: after the Ministry of Finance announced a new concept of the pension system (individual pension capital. Not yet approved), under which citizens must make contributions to their future pensions on their own, the question arose of what will happen to the money of the “silent people”. The idea is to transform them into pension points clearly did not find support among the population. After all, what are Pension Fund points and how does the real size depend on them? future pension, no expert will undertake to explain. In addition, new contributions within the framework of the individual pension capital system, according to the authors of the program, should go to a fund that already contains the savings of a particular citizen. Contributions from those who did not choose a non-state pension fund will go to a randomly selected fund.

It turns out that, in fact, citizens have very little time left to decide on the choice of a non-state pension fund to which to transfer their savings and to which deductions from the individual industrial complex will be received. According to the plan of the Ministry of Finance and the Central Bank, to earn a new pension system due from 2019. True, whether they will have time to pass the necessary law in time is a big question.

In any case, you need to decide what to do with your future pension as soon as possible.

Selection criteria: profitability and large shareholder are more important than geography and personal connections

To help make right choice, Banki.ru decided to interview those who professionally manage pension money - NPFs and management companies. Market participants were asked to prioritize the following fund selection criteria:

- return on investment;

- size of the fund's assets;

- presence of a major shareholder;

- financial indicators: profit, etc.;

- subjective assessment of the fund’s reliability;

- availability of additional services;

- bonuses from the agent;

- presence/absence of negative information about the fund in the media;

- personal acquaintance with the fund’s management;

- geographical proximity to the place of residence;

- possible loss of investment income.

Market participants also had the opportunity to enter their own criterion, which is not on the list, but for some reason they consider it important. A total of 20 largest pension funds and management companies were surveyed.

And this is what happened. Among the most important criteria that must be taken into account when choosing a fund, more than half of the experts surveyed indicated investment profitability, possible loss of investment income and the presence of a large shareholder. The last criterion, according to many market participants, is evidence of the fund's reliability.

According to the General Director of NPF VTB Larisa Gorchakovskaya, “if the shareholder is, for example, a large National Bank, this will be an additional guarantee of reliability.” In addition, she points out, the future pensioner needs to clearly understand where and how the fund accepts documents for the payment of pensions. So that later, to apply for a pension, you don’t have to travel across the country to the only office of the selected fund.

The profitability shown by the selected NPF, as noted by the majority of market participants we surveyed, must be looked at over a fairly long horizon - at least several years. General Director of NPF Lukoil-Garant Denis Rudomanenko says that, given the duration of the formation process funded pension, clients should definitely look at the accumulated profitability. Find out what results your fund shows during the optimal period for evaluation - at least 8-10 years. "Returns over one or two years are not indicative of the performance of the fund managing your pension," he says.

Profitability of the pension savings portfolio of the largest funds in 2016*

| Return on investment, % | Number of clients | Pension savings (thousand rubles, market value) |

|

| "Promagrofond" | |||

| "Gazfond Pension Savings" | |||

| "KIT Finance" | |||

| "Agreement" | |||

| "Safmar" | |||

| "NPF Elektroenergetiki" | |||

| "Lukoil-Garant" | |||

| "Confidence" | |||

| "Future" |

* The ranking includes funds with more than 1 million insured persons.

Since the beginning of 2007, the pension system in the country has been undergoing major changes. They touched upon the opportunity for future retirees to create a base for accumulating contributions. For them, it is necessary to take care in advance about the possibility of transferring contributions from the funded part of the pension to non-state pension funds, management companies, as well as the timing of such a decision, transfer amounts, etc.

Deadlines

Citizens of Russia who carry out labor activity legally have the right to pension contributions. They are given the opportunity to choose where to store their savings (in the Pension Fund or a non-state pension fund).

By law, the employer must transfer the pension to the Pension Fund account. At the same time, the transfer amount is 22% (most of it goes to create the insurance segment). The employee can manage six percent of the total amount of contributions independently. He has the right to leave this amount as part of the insurance pension (that is, all his pension contributions become insurance) or make a transfer to a non-state pension fund and receive dividends on them.

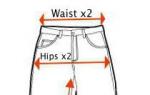

How a pension is formed in Russia, see the picture:

The legal regulation covers the period in accordance with which such a choice must be made. Based on the legal regulations, if the future pensioner has not chosen how to manage his pension by January 1, 2016, then all of it will be considered insurance.

From April 1, 2018, procedures began to be carried out to index such a funded pension and convert it into an insurance one. Also, since the beginning of 2018, transferred funds to the Pension Fund are no longer divided into two parts. In other words, the entire amount goes to the insurance portion. The Central Bank will become the regulatory body for innovations in legislation.

But here is the opinion of the opposition and ordinary people about where the frozen ones went pension savings Russians:

Options for transferring pension accruals

For those individuals who approached the issue of forming their future pension with maximum responsibility and transferred the funded part to the NPF account, other options for managing funds have been identified.

In the case in which a citizen wants to retain the right to dispose of the savings portion and receive interest on it, he transfers the funds to a non-state pension fund. The company for which such a citizen works sends contributions in full to the Pension Fund account. The latter, in turn, divides the amount into insurance and savings (6% is sent to a non-state pension fund).

Where can I transfer my pension?

Where to transfer the funded part of a pension is a difficult task for pensioners. The solution to the question “where is the best place to transfer your pension” is to use two main ways to obtain additional income from pension savings.

The first selection method is considered the most popular. These are contributions to a non-state pension fund. They were created as part of the work of a banking organization and are considered one of its divisions.

The second method involves transferring the right to use royalties to a management company. It carries out financial management of its clients' deposits (trust management) in accordance with its charter.

The differences between the two methods are related to the conclusion of an agreement on compulsory pension insurance for clients. In non-state funds it is considered mandatory for signing. The level of profitability will also differ depending on where you invest your savings.

What are the advantages of NPFs over Pension Funds, we will tell you in the picture:

Determining a place to invest savings

An example of management companies is Vnesheconombank. The task of the organization is to work on investing invested pension savings. Clients' funds can only be invested in low-risk assets.

After transferring your savings, you can choose the investment method, the conditions for their implementation, and create your own investment portfolio:

- Creating a basic portfolio. This includes low-risk government securities and bonds of domestic organizations.

- Expanded view (mortgage-backed securities and bonds of foreign organizations are added).

The return on investments in Vnesheconombank is considered a relative value and depends on the increase in funds in its account.

Investment options VEB portfolios We presented the Criminal Code in the form of a picture:

The activities of non-state pension funds are structured along a different path. To transfer the savings portion, you should carefully study the selected NPF, assess the risks of investments, and its profitability. The translation procedure is as follows:

- selection of a non-state pension fund, analysis of its advantages and possible risks.

- conclusion of an agreement on compulsory pension insurance.

- Transfer of data to the territorial body of the Pension Fund of the Russian Federation on the transfer of funds to an account with a non-state pension fund.

When choosing a non-state pension fund, it is worth studying what type of fund it is related to. Highlight:

- Captive funds, which promote corporate programs within an organization. These are the Transneft and Neftegarant funds. They have a large reserve of savings.

- Corporate foundations work to serve the programs of their parent firms. The level of savings is growing annually (Norilsk Nickel).

- Universal funds work with both individuals, and with companies. These include, for example, “Kit-Finance”.

- Funds belonging to the territorial type operate with the support of the local administration (Khanty-Mansiysk Non-State Pension Fund).

Rating of non-state pension funds

In order not to become a defrauded investor and not be left with nothing after retirement in old age, you should choose a non-state pension fund with extreme caution. Assessing its performance involves analyzing the main indicators of its performance. These include the degree of reliability, financial reputation, stability and riskiness of deposits, and return on investment. The result will be a decision on which pension fund the citizen should go to.

- "Gazfond". It has been operating since 1994. The founders are the companies PJSC Gazprom, Gazprombank, Gazprom Dobycha Urengoy LLC, Gazprom Dobycha Yamburg LLC, Gazprom Transgaz Saratov LLC. Acts as a co-founder of the union of pension market participants on a professional basis. Has an A++ rating according to Expert RA. It is considered the largest fund with the maximum return on deposits and the amount of its own reserves.

- NPF "Sberbank". Founded in 1995. The management company is PJSC Sberbank of Russia. It is distinguished by its reliability and positive customer reviews. It has its own reserves to cover losses of pension savings investors.

- Lukoil-Garant showed good performance results in 2018. Serves about 14% of clients in the country annually. The amount of savings is about 250 billion rubles. A++ reliability rating assigned.

- Promagrofond was founded in 1994, and since 2016 it has become part of Gazfond. The amount of savings is about 8 billion rubles. Actively attracts clients and ensures the maximum degree of reliability of their funded part of their pension.

Also, companies with more low rating(B+, C+). But this indicator reflects the main shortcomings of such organizations, for example, a low reliability indicator, minimal profitability in a given reporting year, etc.

How to find out where the funded part of the pension is located?

All citizens of the Russian Federation receive information about the status of their personal account. It reflects data on the amount of the insurance part and the savings part. To find out where the deductions are, you can use one of the following methods:

- Contact your territorial office for clarification. Pension Fund branch. This is considered the fastest and most reliable way, since this organization contains all the information on pension contributions.

- If it is not possible to submit an application to the Pension Fund, you should contact the accounting department of the organization in which you work.

- Follow the links to the government services website. In the database, when you enter SNILS data, information is provided about where pension contributions are located.

- The last way is to contact the banking institution where you have Pension Fund a cooperation agreement has been concluded.